11:51 am

August 17, 2021

Earlier this month, Jason Mercier of the Washington Policy Center posted a March 26 memo from Rep. Chopp that set out the Legislature’s options for a capital gains tax. For each of the options, Rep. Chopp listed among the cons that legislators could be “attacked for raising taxes while state is ‘awash with money.’”

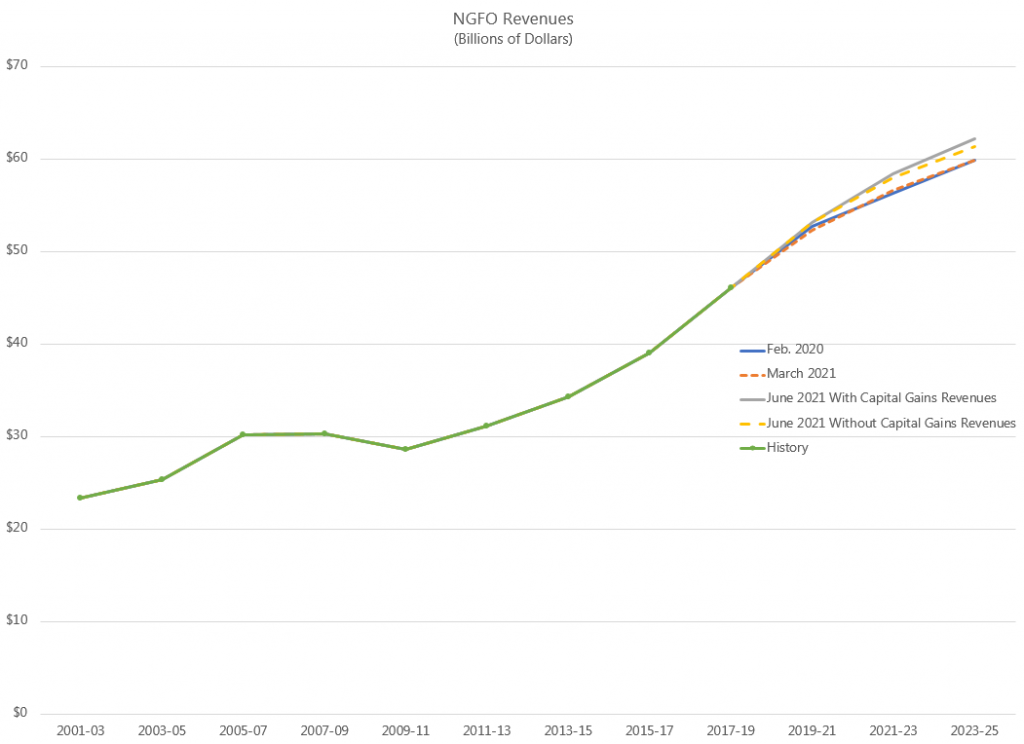

Indeed, by the time the memo was written, it was clear that state revenues were growing despite the recession. The March 17, 2021 revenue forecast estimated that revenues from funds subject to the outlook (NGFO) were up $4.7 million compared to the pre-pandemic Feb. 2020 forecast (over the forecast period of 2019–21, 2021–23, and 2023–25). Even the June 2020 forecast, which expected the biggest negative impact to revenues, estimated that revenues would still grow from 2017–19 to 2019–21. (By contrast, revenues actually declined during the Great Recession from 2007–09 to 2009–11.)

As we wrote in March, with the March forecast, the state budget easily balanced and the state would not need to increase taxes to meet obligations.

Since Rep. Chopp wrote his memo (and since the 2021–23 operating budget was enacted), revenues have increased substantially. The June 2021 forecast estimates that NGFO revenues are above the Feb. 2020 forecast by $4.886 billion (through 2023–25). That includes revenues from the enacted capital gains tax. If you remove the capital gains revenues, the June 2021 forecast is $3.631 billion above the Feb. 2020 forecast.

And, as the Economic and Revenue Forecast Council reported yesterday, general fund–state revenue collections are now $89.8 million higher than forecast in June.